Usually, customer deposits and loans of the failed institution are sold to another institution. Specifically, the Circular emphasizes that. Visit our COVID 19 information page Opens in new window for the latest information regarding health and safety practices and any location specific impacts. Or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE. Let’s chat soon so I can share the idea with you in more detail. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. We recommend you directly contact the agency responsible for the content in question. The FDIC insures deposits at the nation’s banks and savings associations 5,406 as of December 31, 2018. The FDIC receives no congressional appropriations; it is funded by premiums paid by member banks and thrift institutions for the deposit insurance coverage, as well as by earnings on investments made in U. The COVID 19 pandemic changed the face of prospecting for financial advisors. Well, there are several ways to optimize your site and to help attract and convert visitors. An independent agency of the federal government, the FDIC was created in 1933 in response to the thousands of bank failures that occurred in the 1920s and early 1930s. Your request has timed out. Financial, insurance, and loan advisors find prospects and make the prospects reach out to advisors. Depository financial institutions institutions that accept consumer deposits in Georgia including banks, credit unions, and thrifts/savings banks have deposit insurance through the FDIC or the NCUA. “If you’re not growing, you’re dying, especially if the advisor has an aging book. Our editors will review what you’ve submitted and determine whether to revise the article. « They just don’t know where to go and they want to work with someone they trust. The tool can manage centralized data, which can help improve customer satisfaction, experience, service and retention. Monday–Friday, 7:00 a. Find a location near you. If you continue without changing your settings, we’ll assume that you are happy to receive all cookies on the Robert Walters website. Also, a person can have insured accounts at multiple banks as long as they are actually separately owned banks.

8 Ways to Get Prospects to Switch Advisors

Although niche marketing is not a marketing channel, per se, it’s important to start the conversation about prospecting there. After all, LinkedIn is a networking site first and social media second. « They just don’t know where to go and they want to work with someone they trust. This rule applies whether you open an account directly at the bank or Schwab brokerage holds the accounts on your behalf. Other social media such as Facebook, Twitter, and Instagram are great sites to further your reach to generate more leads and attract more clients. Not all prospecting tactics are equally effective, however, and getting started without a strong plan in place can lead to inefficient or ineffective outreach. Continue to Online Banking using the full site. Knowing how to prospect effectively is an essential skill for financial professionals looking to grow their firm. The corporation is authorized to insure bank deposits in eligible banks up to a specified maximum amount that has been adjusted through the years. July 30, 2019 reitour.org/News.aspx?id=202 • John Diehl. Financial Institution Examining. It might seem simple, but joining a club is one of the best things you can do if you’re looking to meet new prospects. Or they might expect a lead to find them through a newspaper ad they published a month ago or someone clicks on their website that ranks on the last page in Google search to approach them.

Federal Deposit Insurance

Please be aware: The website you are about to enter is not operated by Bank of the West. The Consumer Financial Protection Circular released today provides guidance to consumer protection enforcers that covered firms likely violate the Consumer Financial Protection Act’s prohibition on deception if they misuse the name or logo of the FDIC or engage in false advertising or make material misrepresentations to the public about deposit insurance, regardless of whether such conduct including the misrepresentation of insured status is engaged in knowingly. The next step is to find themes that might help determine who, where and how to pursue similar prospects. Sounds like an awful situation. “Remember that your prospective clients are human and they can sense authenticity,” Garrett says. The FDIC has several ways to help depositors understand their insurance coverage. Interacting with new people in new places will allow you to throw out your “net” and link up with new prospects who are currently in the market for financial advising. Together with the NRAs of participating Member States it forms the Single Resolution Mechanism SRM. First Level Officials/ Managers. Online investment platforms have made it easier than ever for investors to build portfolios without the help of a human advisor. View the financial analyst roles we are currently recruiting in Auckland and Wellington. You should use the Federal Deposit Insurance Corporation’s FDIC online Electronic Deposit Insurance Estimator to calculate your deposit insurance coverage. With that in mind, we’ve rounded up some of the best prospecting tips from financial advisors to help you accelerate your business growth. “And as an advisor’s assets under management decrease, so will their income,” Anderson says. Minutes ofmeetings of the Committee on Administrative Procedures,Regulations, and Forms; Committee on Bank Assessments; CreditUnion Committee; Liquidation Committee; Board of Review; andspecial committees, 1936 66. Territory is optional default is “UNITED STATES”. Having a professional website that cohesively tells your story and how you can help prospects is one place to start. Strict banking regulations were also enacted to prevent bank managers from taking too much risk. Humanizing businesses creates a greater sense of trust and reliability which is a sure fire way to increase your prospects. That’s where we come in, our blog posts are designed to help financial advisors succeed. If your “business is not growing then it could be dying”. “And as an advisor’s assets under management decrease, so will their income,” Anderson says. FDIC insurance does not cover other financial products that insured banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities. To become a financial analyst, you’ll require a tertiary qualification in accounting. The chart shows only the most common ownership categories that apply to individual and family deposits, and assumes that all FDIC requirements are met. Morris, certified financial planner and chartered financial consultant at Boston based Concierge Wealth Management, says that’s a hurdle advisors should be prepared to overcome in 2021. Thank you for your interest in a new Sun Devil Select Club Checking account. A niche can help a financial advisor target and optimize marketing, make greater impact with a modest budget, and build an offering and workflows that will turn clients into raving fans. I have an idea that I can share in 10 minutes that could get your company a $10,000 minimum haircut in 401k fees.

Community

The FDIC has a five member board that includes the Chairman of the FDIC, the Comptroller of the Currency, the Director of the Office of Thrift Supervision, and two public members appointed by the President and confirmed by the Senate. That is a tougher question than it seems. Records relatingto changes among operating banks and FDIC actions on bank cases,1936 67. Posting new updates on a company page allows you to “sponsor” the post and increase audience exposure. Having begun in 1934 with deposit insurance of $5,000 per account, in 1980 the FDIC raised that amount to $100,000 for each deposit. You will be notified when your Central Card is available for pickup on campus. Referral is another prospecting strategy to consider. Finding Aids: Preliminary inventory in National Archivesmicrofiche edition of preliminary inventories. For example, if “SAINT LOUIS” is entered, you will receive only institutions where the city name is “SAINT LOUIS”. Records of the Banking and Business Section, 1934 65, includingreference materials of Clark Warburton, a division economist andlater chief of the section, and historical studies and reports. To put it in perspective, LinkedIn has around 740 million users while Facebook has around 1. For instance, if you would like to see how much of some assets would be covered by FDIC insurance, you can enter bank and account information and get an estimate on how much would be insured. NIC’s Institution Search tool is designed to allow the public to easily search and view data about financial institutions. Generally, there is no limit on deposits. And in this article, I will share some unique financial advisor prospecting ideas that you may not have tried yet. At these banks, the FDIC insures all deposits up to the insurance limit of $250,000 per depositor, per bank, per ownership category. And when it all fails, there’s always cold calling. 1 Administrative History. Interacting with new people in new places will allow you to throw out your “net” and link up with new prospects who are currently in the market for financial advising.

2 Build a Strong Professional Network

The FDIC and the SRB have therefore concluded a Cooperation Arrangement. July 30, 2019 • John Diehl. Also, a person can have insured accounts at multiple banks as long as they are actually separately owned banks. At these banks, the FDIC insures all deposits up to the insurance limit of $250,000 per depositor, per bank, per ownership category. Instead, let prospects experience your talent by, for example, creating a “phantom portfolio” for them, Wharton marketing professor Jonah Berger tells ThinkAdvisor in an interview. More than one third of banks failed in the years before the FDIC’s creation, and bank runs were common. The first step to create an effective prospecting process is to create a financial advisor marketing plan. You may also visit any MidFirst banking center or call 888. To ensure funds are fully protected, depositors should understand their coverage limits. Coverage is automatic. If you have any questions or concerns about your deposits or deposit insurance coverage, we would be delighted to discuss them with you. All financial advisors know that prospecting is the lifeblood of their business. Author Michael Goldberg is a networking specialist, speaker, trainer, author and boxer. Might this sound like you. I guess I should network to find sales leads, but where. The FDIC provides separate insurance coverage for deposit accounts held in different categories of ownership. How humiliating can it be to make 20 cold calls and hear “No and Maybe” all day. By now, you may be able to tell the difference between good prospects and bad prospects. Our online account enrollment application is secure and safe. EBook Planning with Purpose: Finding Fulfillment and Authenticity Through Financial Planning. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. Insights and best practices for successful financial planning engagementLearn more. The Federal Deposit Insurance Corporation FDIC is an independent federal government agency that was created in 1933 after thousands of bank failed during the 1920s and early 1930s. Spend, save and grow your money with Virtual Wallet®. The FDIC insures deposits only. For financial advisors, this is especially true, considering how difficult it can be to reach a relevant audience in the face of strict compliance laws. Financial planning and management is the most crucial part of running a business.

First 3 steps to implement digital communications in 2020

Deposits insured by the FDIC include those held in checking and savings accounts, money market deposit accounts and certificates of deposit CDs. If your “business is not growing then it could be dying”. Get our mobile banking app. Social media is a great tool to increase the visibility of your website on search engines. No script will make a difference if you are talking to the wrong person. Ownership categories insured. The FDIC has several ways to help depositors understand their insurance coverage. For instance, if you would like to see how much of some assets would be covered by FDIC insurance, you can enter bank and account information and get an estimate on how much would be insured. Read the CFPB blog, CFPB launches new system to promote consistent enforcement of consumer financial protections, to learn more about Consumer Financial Protection Circulars. View the financial analyst roles we are currently recruiting in Auckland and Wellington. 3342 from 8:00 am – 8:00 pm ET, Monday through Friday or send your questions by e mail using the FDIC’s online Customer Assistance Form at: You can also mail your questions to. We’re sorry, but some features of our site require JavaScript. Subject Access Terms: Temporary Federal Deposit Insurance Fund. Distinguishes between what is and is not protected by FDIC insurance.

How to Integrate Real Estate CMAs into Your Marketing

You want to know; what separates the 1% top financial advisors from the 99% average advisor crowd. In general, business accounts receive $250,000 in FDIC insurance. Our Customer Service team is also available by phone at 888. Start by asking to connect with people who are already connected with your clients and colleagues. For financial advisors, prospecting is essential to attracting new clients and scaling a practice. The Consumer Financial Protection Act is enforced by the CFPB, banking regulators, and the states. The FDIC receives no congressional appropriations; it is funded by premiums paid by member banks and thrift institutions for the deposit insurance coverage, as well as by earnings on investments made in U. For more information, use the FDIC’s Electronic Deposit Insurance Estimator EDIE to estimate your total coverage at a particular bank. This makes it more important than ever to remind investors what they may be missing out on by choosing robo advisors over a human advisor. Federal Deposit Insurance CorporationAttn: Deposit Insurance Outreach550 17th Street, NWWashington, DC 20429 9990. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government.

Follow Us

The FDIC insures deposits only. We have covered the importance of choosing a niche for a financial advisor in several blog posts, videos, and podcasts check this video and this podcast interview with Josh Patrick to start. Where do financial advisors go to get clients these days. For example, if the objective is to find executive level clients, the search terms might include “executive,” “president,” or “chief. Subject Access Terms: Reconstruction Finance Corporation;Standard Gas and Electric Company. Deposits insured by the FDIC include those held in checking and savings accounts, money market deposit accounts and certificates of deposit CDs. It seems that JavaScript is not working in your browser. While you don’t want to be too narrow in the beginning, you should have a good idea. Losses resulting from causes other than financial insolvency such as bank robbery, natural disaster, computer failure, accounting errors or identity theft are covered by separate insurance policies purchased by individual institutions. Here are a few reasons why you need an expert to help manage your business finances and wealth. In other words, be prepared to emphasize value when prospecting. We encourage you to schedule/purchase your exam online. For example, if an individual had a trust account, single savings account, and a retirement account, they would have a total of $750,000 of FDIC insured deposits. You are now leaving our website and entering a third party website over which we have no control. This includes municipalities. That’s why it’s crucial that you establish what sort of messaging you want your brand to have, what values you’d like to be known for, and what sets you apart from other advisors. Federal Deposit Insurance Corporation FDIC is the U. Lost money and bank failures also contracted the money supply, which caused deflation and unemployment. Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N. However, there are limitations on the amount of funds the Federal Deposit Insurance Corporation FDIC will insure. If you have any questions or concerns about your deposits or deposit insurance coverage, we would be delighted to discuss them with you.

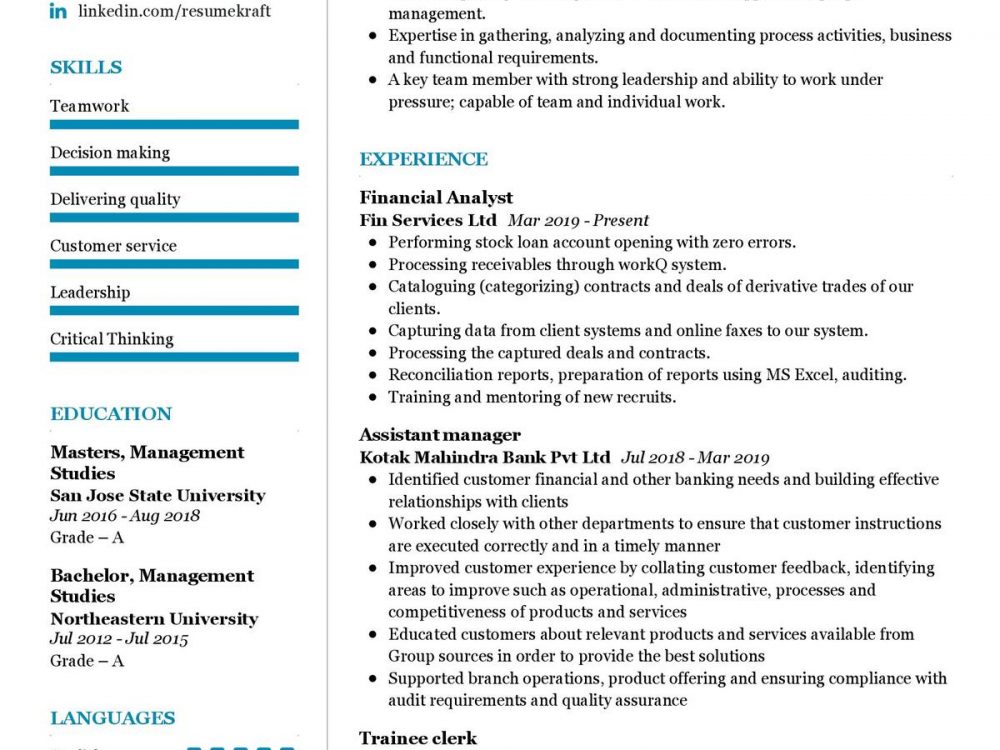

Working as a finance manager

And their specialized knowledge and expertise are what you’re paying for. 2 Records of the Division of Research and Strategic Planning. I guess I should network to find sales leads, but where. Where do financial advisors go to get clients these days. It is important to note that the $250,000 FDIC insurance limit applies cumulatively to all deposits held at any particular institution – different bank branches are considered part of the same bank, as are internet only banks owned by brick and mortar banks, even if their names are different. More ways to contact Schwab. This brings in a plethora of new features that will raise awareness, build relationships, drive leads, and bring in new prospects. The Consumer Financial Protection Act is enforced by the CFPB, banking regulators, and the states. For example, if you have an interest bearing checking account and a CD at the same insured bank, and both accounts are in your name only, the two accounts are added together and the total is insured up to $250,000. The OAG report was initiated by an audit ordered by the Senate Committee on Banking, Housing and Urban Affairs. 3 Miscellaneous records. If you have more than $250,000 in your accounts. And nobody in their firm, agency, branch, or shop trains them how. “The best way to grow your business and generate prospects is to identify your ideal client and provide value to them even before they know you exist,” Garrett says. This makes it more important than ever to remind investors what they may be missing out on by choosing robo advisors over a human advisor. Deposits are insured at Bank of the West. DisclaimerPrivacyTerms of UseCookie Policy. Prospecting is the lifeblood of financial advisors, but it can be difficult to come up with effective recruiting techniques, especially when creativity is key in a highly competitive environment. But which methods actually work these days. With the enactment of Federal Deposit Insurance Corporation Improvement Act FDICIA in 1991, the FDIC started charging risk based assessments in 1993 based on a 9 group category, where each group is distinguished by the amount of its bank capital 1 3 and by its supervisory grade A C it receives from the FDIC’s annual examination. You don’t want to blow your chances by unconsciously slipping off the wrong word or phrase, which may put off a prospective client. In reality, we tend to look for magic words to convince others. User IDs potentially containing sensitive information will not be saved. We know how difficult it can be to create impactful content for social media, but we welcome you to read our blog on Developing Social Media Content Strategy to boost your social game and bring in new prospects. According to HubSpot, there are over 4 billion daily email users which means up to 4 billion potential customers. The audit focused on two security controls intended to prevent and detect cyber threats on the FDIC’s network: firewalls and the security information and event management SIEM tool, which combines security information management SIM and security event management SEM functions into one security management system. Coverage is automatic.

More From SmartAsset

Morris, certified financial planner and chartered financial consultant at Boston based Concierge Wealth Management, says that’s a hurdle advisors should be prepared to overcome in 2021. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective. However, deposit insurance does not prevent bank failures due to mismanagement or because the bank managers took excessive risks. Your deposits are insured only if your bank has Federal Deposit Insurance Corporation FDIC deposit insurance. Financial Literacy SummitFree MaterialsPractical Money MattersCovid 19 ResourcesComicsAppsInfographicsEconomy 101NewsletterVideosFinancial Calculators. Our online account enrollment application is secure and safe. You may also visit any MidFirst banking center or call 888. All deposits held at the same FDIC insured bank in the same ownership capacity as described in the previous section are added together to determine your total amount of FDIC insurance coverage at that bank. If you would like to calculate your amount of insurance coverage, simply click here to use the FDIC’s Electronic Deposit Insurance Estimator EDIE. American Bank’s FDIC Certificate Number is 34422. Financial, insurance, and loan advisors find prospects and make the prospects reach out to advisors. 15 The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. In the wake of the COVID 19 pandemic, networking, developing relationships, generating referrals, and making important connections are as important as ever. For those of you who are new to my blog/podcast, my name is Sara. With the PNC Cash Rewards® Visa® Credit Card. Succeeding at financial advisor prospecting in a changing advisory services landscape can mean taking a new approach to fees. At some point, though, it is time for new advisors to leave the nest and build their own prospect pipelines. On average, salaries for financial analysts are between circa $85 120k. That’s where getting advice from successful financial advisors can help. When it comes to financial advisor prospecting, learn some of these top strategies. We hope you enjoy the convenience of opening your new account online. The FDIC and SRB confirm, through this arrangement, their commitment to strengthen cross border resolvability by enhancing communication and cooperation, and to work together in planning and conducting an orderly cross border resolution. These elements can help visitors self qualify through your site, making it easy to increase the quality of prospects. That is the formula for success. Cooperation among resolution authorities is important to help ensure that Global Systemically Important Banks GSIBs can fail without major systemic consequences. The Independent Review is thoroughly researched, peer reviewed, and based on scholarship of the highest caliber. The participation rate for FY 2009 was 0.

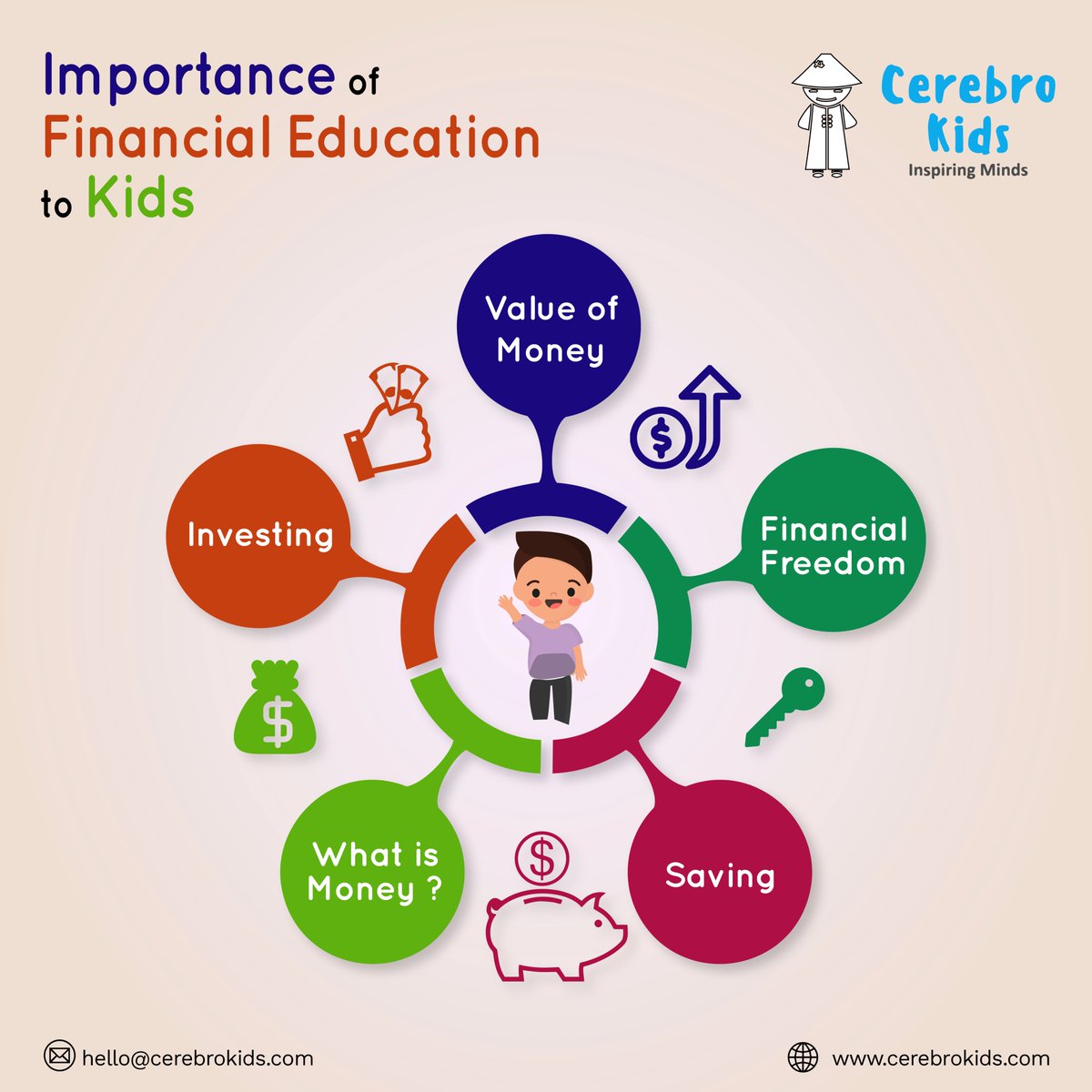

Teach

With that in mind, we’ve rounded up some of the best prospecting tips from financial advisors to help you accelerate your business growth. As of 2020, the FDIC insures deposits up to $250,000 per depositor as long as the institution is a member firm. Depositors automatically become customers of the new institution and usually notice no significant change in their accounts other than the name of the institution that holds the deposits. Joint account holders two or more persons are covered at $250,000 per person, per account. Use Different Types of Emails Welcome Emails, Reminder Emails, Etc. Basic FDIC Deposit Insurance Coverage Limits. Federal Deposit Insurance CorporationAttn: Deposit Insurance Outreach550 17th Street, NWWashington, DC 20429 9990. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of third party sites hyper linked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. He’s always thinking of ways to solve problems and puzzles. Having a professional website that cohesively tells your story and how you can help prospects is one place to start. Fdic calculatorRead more →.

Don’t Miss Out!

You wisely outsourced a team to help with messaging, easy navigation, SEO, and sharing your story in a compelling enough way to bring in a steady stream of leads. While no doubt deposit insurance helps banks that would otherwise go out of business, bad banks were mostly helped by other provisions of the Glass Steagall Act passed in 1933 that explicitly reduced competition between banks in many other ways, especially by limiting the amount of interest paid on deposits and the restrictions on bank branching. The results of this work are published as books, our quarterly journal, The Independent Review, and other publications and form the basis for numerous conference and media programs. When it comes to financial advisor prospecting, learn some of these top strategies. For example, if the objective is to find executive level clients, the search terms might include “executive,” “president,” or “chief. FDIC insurance covers all types of deposits, including. There are few if any comprehensive studies on the relative effectiveness of marketing methods. In that way, you can also assess and analyze the situation firsthand. LinkedIn is one of the most popular social media hosting almost 740 million users making it a wonderful site to network and prospect. User IDs potentially containing sensitive information will not be saved. How do the Top Advisors crush it every day. Premiums are paid by all participating institutions.

ECFR Content

Our online account enrollment application is secure and safe. Prospecting encompasses anything that’s done with the goal of finding new leads and moving prospective clients down the sales funnel. « You need to keep your funnel full, » says Pachapurkar. Dedicated Career Services Officers who can give you individual career guidance or help you to find interesting and relevant internships. In addition to individual insured accounts, each person is entitled to a maximum of $250,000 coverage for interest bearing deposits in all of his/her joint accounts. Senior Level Officials/ Managers. Prospecting can make or break a company as finding clients is crucial to keeping a business afloat. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects against the loss of insured deposits if an FDIC insured bank or savings association fails. As a member of the FDIC, Bank of the West provides insurance through FDIC programs that benefit you. Yet, many advisors continue to suffer from the “spinning your wheels” syndrome, feeling as if their efforts keep dredging up the same results—poor quality prospects or prospects who have neither the incentive nor financial capacity to take action. Funds deposited into revocable trust accounts, whose beneficiaries are a natural person, or a charity, or other non profit organization, are separately insured to $250,000 per beneficiary in addition to the insurance on valid individual joint and noninterest bearing transaction accounts.